Playter launches Ari to fix the broker bottleneck holding back SME funding

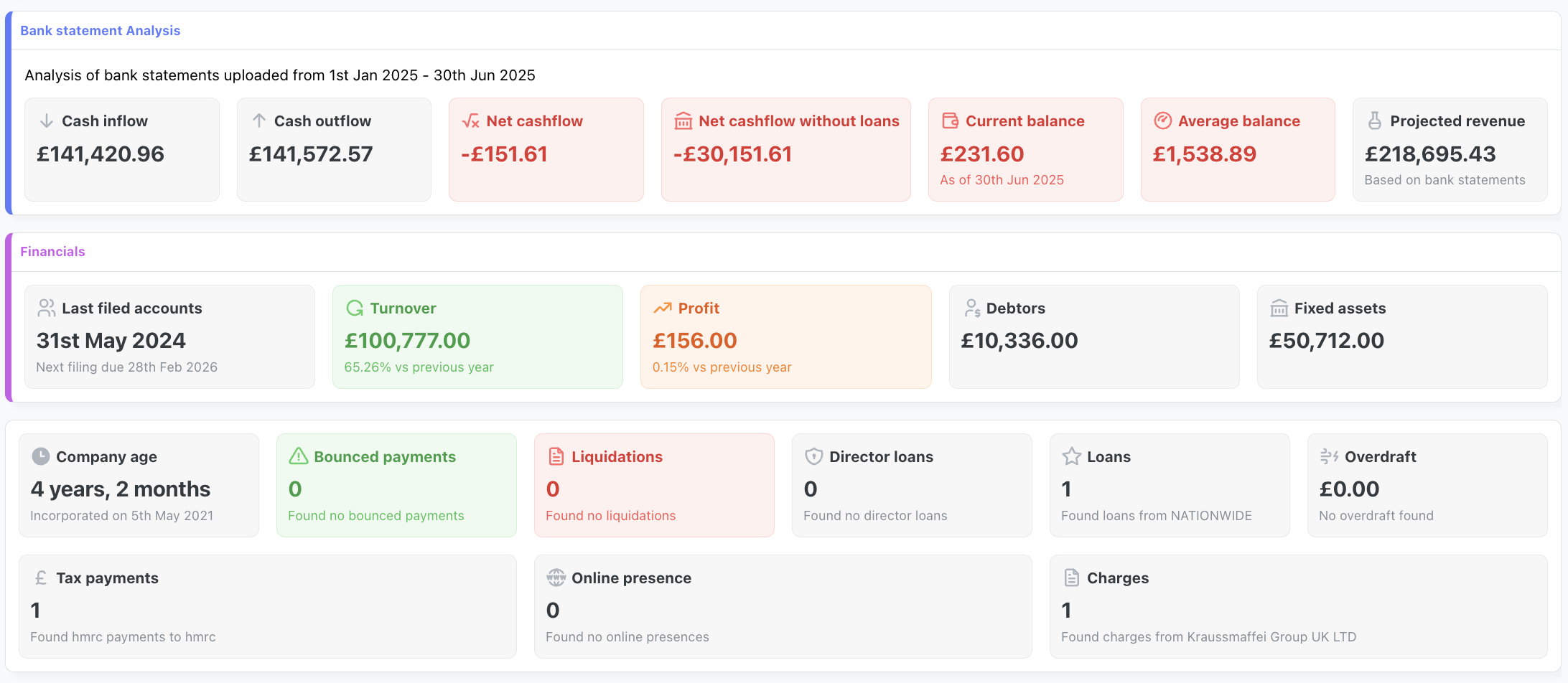

Most small businesses never make it past their first funding rejection. Playter has built Ari to solve this bottleneck with AI-powered risk analysis that reduces deal analysis time from 60 minutes to 30 seconds.

Read full article